Buying your first home is exciting—but it can also feel overwhelming, especially when you see your estimated monthly mortgage payments. If you’re looking for a way to ease into homeownership with lower initial payments, the 2/1 Buydown program might be the perfect solution.

At CENTURY 21 Connected, we’re committed to helping first-time buyers in Hendersonville, Asheville, Brevard, and beyond navigate their options—and the 2/1 Buydown Program is a smart strategy you should know about.

What Is a 2/1 Buydown?

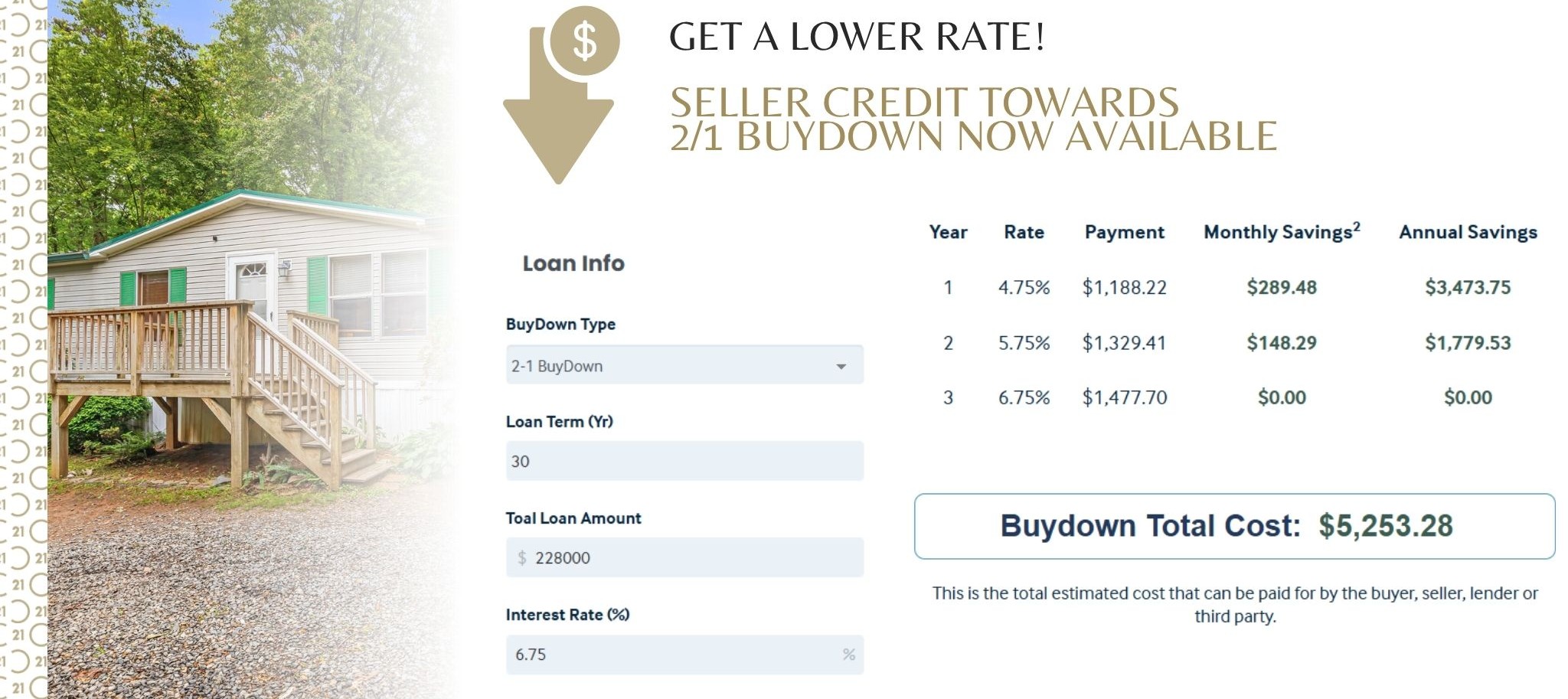

A 2/1 Buydown is a temporary interest rate reduction program that lets you enjoy significantly lower mortgage payments during the first two years of your loan:

✅ Year 1 – Your interest rate is reduced by 2%, giving you the lowest monthly payments in the early months of homeownership.

✅ Year 2 – The rate steps up by 1%, but still remains lower than your fixed rate.

✅ Year 3 and beyond – Your payments adjust to the full fixed interest rate you locked in at closing.

This program can be a lifesaver for first-time buyers who want some breathing room to furnish their home, build savings, or simply settle in.

Example: See the Savings

For the property 15 Robin Lane, Asheville, North Carolina 28806 – Priced at $285,000.

Subject to investor guidelines. These calculations are tools for educational/estimation purposes only. Payments shown are estimates and do not include amounts for taxes and insurance premiums (if applicable). The actual payment obligation will be greater. This does not constitute an offer or approval of credit. Contact a Movement Mortgage home loan officer for actual estimates. Breakdown assumes list price of home at $285,000 with 20% down for a loan amount of $228,000. Monthly savings based on initial period payments (based on buydown type) compared to payments after rate returns to its regular rate before the buydown. Note Rate pulled 6/26/25, rates subject to change. Scenario used a 740+ credit score, owner-occupied/primary residence, with 20% down payment and minimum loan amount of $250,000. Loans are subject to borrower qualifications, including income, property evaluation, and final credit approval. Temporary buydowns must be paid for by seller or builder. Certain loan programs do not allow buydowns, additional restrictions apply. Payment shown is principal and interest and does not include amounts for taxes and insurance (if applicable). The actual payment obligation will be greater. Contact your Movement Mortgage loan officer for more details.

How Does the Buydown Work?

-

The buydown cost is typically paid upfront by the seller, builder, or lender as a concession at closing—meaning it might not even come out of your pocket.

-

The funds are held in an escrow account to cover the difference in payments during the first two years.

-

This strategy helps sellers move their homes faster and buyers afford their dream home sooner.

Why It’s Perfect for First-Time Buyers in Hendersonville, Asheville & Beyond

In our competitive Western North Carolina real estate market, the 2/1 Buydown can give you an edge. It can:

✅ Make monthly payments affordable when you need it most.

✅ Allow you to buy a home sooner instead of waiting for rates to drop.

✅ Give you time to adjust your budget as you settle into your new community.

Ready to Learn More?

At CENTURY 21 Connected, we’re here to guide you through every step of your homebuying journey. Let’s talk about whether the 2/1 Buydown is right for you and help you find the perfect home to match your budget and lifestyle.

Movement Mortgage Contact Information

Chris Caldwell

Senior Loan Officer, NMLS# 1996815

📞 828.712.5338

📧 chris.caldwell@movement.com

🏢 101 E. Allen St, Hendersonville, NC 28792

🔗 movement.com/lo/chris-caldwell

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link