For a growing number of homeowners, retirement isn’t some distant idea anymore. It’s starting to feel very real.

According to Realtor.com and the U.S. Census, nearly 12,000 people will turn 65 every day for the next two years. And the latest data shows as many as 15% of those older Americans are planning to retire in 2026, with another 23% planning the same in 2027.

If you’re considering retiring soon, here’s what you should be thinking about.

Why Downsize?

Now’s the perfect time to reflect on what you want your life to look like in retirement. Even though your finances will be going through a big change, you don’t necessarily want to feel like you’re living with less.

What most people want instead is for life to feel easier:

-

Easier to enjoy.

-

Easier to manage.

-

Easier to maintain day-to-day.

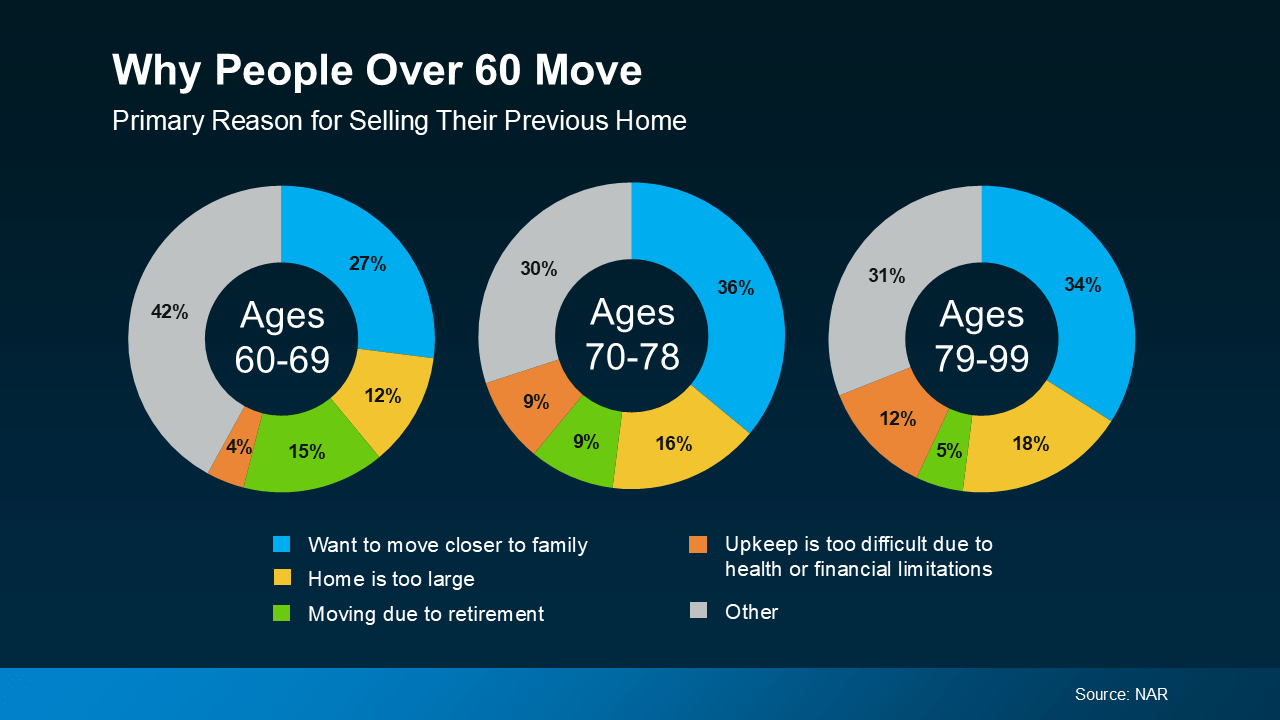

The Top Reasons People Over 60 Move

The National Association of Realtors (NAR) reports that for homeowners over 60, the top reasons for moving aren’t about timing the market or chasing top dollar—they’re about lifestyle:

-

Being closer to children, grandchildren, or long-time friends, making it easier to spend more time with the people who matter most.

-

Choosing a smaller, more functional home with fewer stairs and easier upkeep.

-

Retiring and no longer needing to live near the office, giving the freedom to move wherever you want.

-

Reducing monthly expenses tied to utilities, insurance, and maintenance.

No matter the reason, the theme is the same: downsizing isn’t about giving something up—it’s about gaining control and choosing simplicity. It brings peace of mind to know your home fits the years ahead, not the years behind.

And the best part? It’s more financially feasible now than many homeowners would expect.

The #1 Thing Helping So Many Homeowners Downsize

Here’s what makes it possible: thanks to home values growing over the years, many longtime homeowners are realizing they’re in a stronger position than they thought to make a move.

According to Cotality, the average homeowner today has about $299,000 in home equity. For older Americans, that number is often even higher simply because they’ve lived in their homes longer.

When you stay in one place for years—or even decades—two things happen simultaneously:

-

Your home value increases over time.

-

Your mortgage balance shrinks or disappears.

This combination creates more options than you might expect, even in today’s market.

Whether you just retired or are about to, it’s not too soon to start thinking about what comes next. Sure, leaving the house you’ve made so many memories in can be hard, but maybe it’s time to close one chapter to open a new one that’s just as exciting.

Bottom Line

Downsizing is about setting yourself up for what comes next—on your terms.

If retirement is on the horizon and you’ve started wondering what your current house (and your equity) could make possible, the first step isn’t selling—it’s understanding your options.

A simple, no-pressure conversation can help you see what downsizing might look like—and whether it makes sense for you.

Downsizing in Western North Carolina

This national trend could very well be the reality here in Western North Carolina. Areas like Hendersonville, Asheville, Boone, Waynesville, and beyond are attracting retirees and downsizers who want homes that are easier to manage, closer to family, and set in the beautiful mountains.

At CENTURY 21 Connected, we help local homeowners explore their options:

-

Selling your current home to buyers who are looking to downsize.

-

Finding the perfect smaller home that meets your retirement lifestyle needs.

Our agents know the WNC market inside and out and can guide you every step of the way—making sure your next move is smooth, stress-free, and tailored to your goals.

Ready to explore your options? Contact us today, and let’s talk about how downsizing could work for you in Western North Carolina.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link